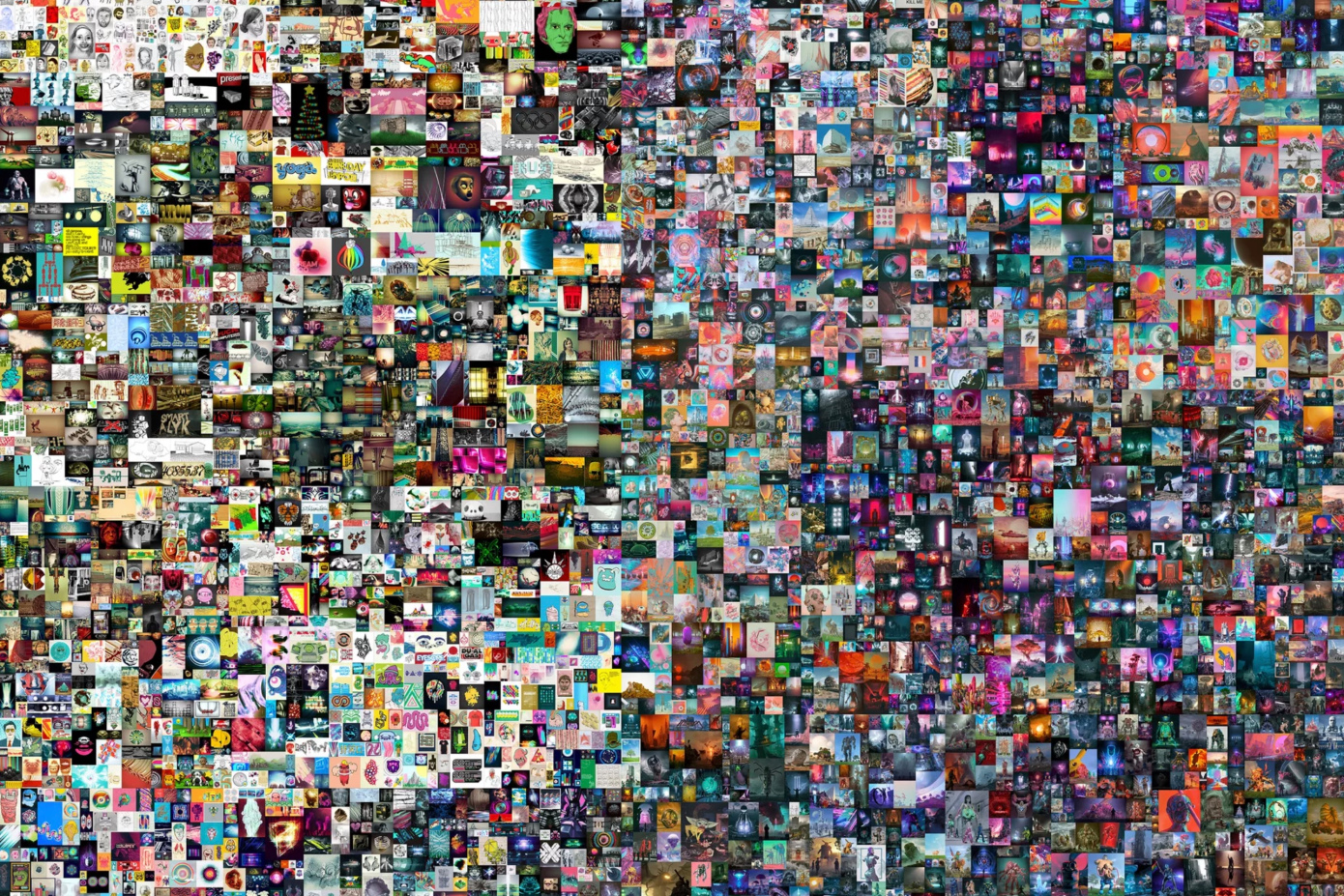

Featured image: Everydays—The First 5000 Days by Beeple

NFTs offically met Magic: the Gathering last week when Kirsten Zirngibl and Peter Mohrbacher minted the very first Magic artwork turned into non-fungible tokens. Each was listed on the trading platform Foundation for 20 ETH, or approximately $35,000 when the article was written.

The pieces only remained available for a few hours at which point both were subsequently de-listed by the artists of their own volition. Zirngibl cited on Facebook in a private group they would wait until Wizards of the Coast made an official statement on whether or not their copyrighted artwork could be translated and sold as an NFT. Mohrbacher followed suit shortly after.

Islands by Kirsten Zirngibl and Peter Mohrbacher.

Wizards has since made that announcement internally. While I have not seen, and am therefore unable to publish, the letter sent from Wizards of the Coast to their artists, there have been several posts by artists summarizing the letter’s contents. In short, Magic: the Gathering artists are not allowed to create NFTs of their Magic work to be sold on the blockchain. No additional reasoning from the artists that shared has been provided, so it’s unclear whether there was any justification or explanation included.

Before NFTs, if an artist who worked exclusively digital wanted to participate in the market for original Magic artwork, they would make a 1/1 giclée print, often with some degree of hand embellishing, and alongside a certificate of authenticity stating that this would be a singular printing on a certain medium at a certain size. This created a 1/1 work related to the card art, and something for collectors to acquire.

Bedevil by Seb McKinnon, a suite of work including 1/1 canvas print.

Fan favorite artists like Seb McKinnon and Jenn Ravenna have both found success using this method, and have offered a number of their works in this form, either through direct sale or as Kickstarter tiers for their various film fundraising campaigns. It’s a recent trend that’s grown as the market for original Magic: the Gathering artwork has risen over the last few years.

It would stand to reason that NFTs could potentially replace these digital-to-physical representations. Today, a traditional artist can sell a physical painting of their card art as a part of their contract, alongside prints and playmats through properly licensed channels. Are NFTs not the digital artists version of that same thing? And if the artists themselves can’t mint them, does that mean that the corporation could then sell the NFTs? What does that mean for originals and artist contracts moving forward? These are some of the questions for today’s article.

I decided to pivot this week’s Mirror Gallery to a more in-depth explanation of this topic after artist Karla Ortiz posted this article by Jisu Choe to her Facebook and Twitter, and I began to dig into this massive topic. I’m not even going to scratch the surface of their research or artist case studies and references, but rather us it to provide some much needed context.

What is an NFT? What is a Blockchain?

First things first, what is a non-fungible token? And the place where it lives, the blockchain?

Everydays—The First 5000 Days by Beeple. Digital. Sold for $69m+.

It’s a digital version of an artwork that lives in something called the blockchain and is purchased with cryptocurrency, in most cases one in particular known as Etherium. An NFT can be owned and transferred, bought and sold; and because it’s a 1/1, they generally follow the same rules of scarcity and exclusivity as other one-ofs in art, artifacts, and collectibles. The blockchain acts as a digital ledger where each transaction is available and publicly recorded. Note that it uses usernames, and that does allow for buyers, and to some degree sellers, to remain anonymous, or not who they seem to be—more on that later.

The blockchain system is decentralized, meaning that not one person, bank, or entity owns or controls the blockchain. It also means that a blockchain is not regulated outside of its own forces. Blockchains are encrypted, which is supposed to keep the data safe while keeping the transactions public.

The Problems With and Arguments Against NFTs

I don’t have the bandwidth or the word count to detail all of the issues surrounding NFTs. You can read a much more comprehensive take if you’re curious to see numbers and arguments broken down and analyzed.

Environmental Impact

The creation, sale, and storage of NFTs use energy. Maintaing the ledger that is the blockchain uses energy. It takes energy to mine (read: create) Bitcoin and for it to serve and transact as a digital currency.

There are a lot of numbers that have been thrown around online as to just how much energy the blockchain, Bitcoin, Etherium, or even measuring a single NFT transaction uses. And the fact is, they’re all estimates. None of these transactions exist within a vacuum, and there is no definitive and consistent measurement of each step of the process. But comparatively, it does use a considerable amount of energy for what it’s doing. If you explore the graphs and data present in Jisu’s article, you find that Bitcoin is a fractional percentage of technology’s overall global carbon footprint, and subsequently a less popular cryptocurrency like Etherium is even less so, but that’s still not nothing.

This energy usage is a concern and it will continue to be a concern as the technology grows. These issues are something that need to be further understood, at the very least improved upon, and will ultimately be a major component to NFTs survival. If the environmental factor isn’t solved, or at the very least explained, it will be a long road to haul. Groups like NEAR are working towards climate neutral blockchains, but these things are still very much in development.

Predatory Outcomes

Criminal and monetary issues that surround NFTs, from art theft and copyright infringement to money laundering and market manipulation. These things all exist in the art world outside of this new digital space and, unfortunately, it only makes sense they’re in this space as well. This is not a free pass for NFTs to follow suit and the article points out several ways in which this marketplace has a better chance of fighting some of these very things.

From the legitimacy and visibility of the blockchain to how money is transferred between parties, NFTs could hold some of the answers to combat these longstanding problems. But as it stands, the possibility that someone could rip off an artists work, “become” them in an online space, sell it, and disappear is still very real. The same is true for collectors, as the username system shows only what is publicly presented, and perhaps not who is behind the screen (very much like the real art world). It will take strides in verification systems and copyright protection to combat this, and I’m still sorting out how different places are handling this issue.

Will there still be art thieves, money launderers, and bastard-coated bastards with bastard filling harming artists and their work? Yes. But the idea that NFTs could create solutions that translate to the physical and fine art markets is optimistic as opposed to outlandish.

What Does This Mean for Magic?

We’ve learned a little about NFTs, what’s happened so far, and where we might be headed in the future. They are a new digital equivalent to traditional paintings that can be bought, sold and traded, and ultimately have value based on their scarcity. They do not transfer copyright, and other than being unable to physically hold and hang them on your wall, they function similarly to a traditional painting in this space—at least to a certain type of owner or collector. That also means they come with the inherent problems from the traditional art market in security, as well as new environmental concerns.

Looking at NFTs through the lens of a digital Magic: the Gathering artist, they are an opportunity for artists to join the rapidly rising market for original works from the game, without sacrificing or adjusting their medium of choice. A handful of Magic artists have begun to offer and sell personal works of theirs to resounding success; if the NFT market is anything like the traditional market, it means the offering of a published Magic work could yield exponential results—if the artists are allowed to do so. For a traditional artist, it means the short deadline work that had to be done digitally now potentially has “original” money attached to it, as well as the option to offer digital preliminary work that would be otherwise lost to a hard drive.

For a cryptocurrency-using collector, NFTs are likewise an opportunity to collect something without sacrificing their currency of choice, and within a space in which they exist. NFTs present art to an entirely new group of collectors in a form that may better resonate with them. I’ve been in the antiques business for the last 15 years and watched this same change spell success for those who adapt. It’s about meeting a new group of buyers and collectors where they are, and connecting them with something that personally resonates, even if that’s not a physical object.

As it stands right now, I don’t agree with Wizards’ apparent decision to disallow artists from creating NFTs. My opinion on this could absolutely change if it’s found that copyright can’t be protected or that NFTs cannot evolve into a safer and less negatively impactful technology in terms of energy use. There are real problems surrounding NFTs, but I believe these issues are solvable, and that it could be an entirely new frontier and life changing opportunity for folks working digitally. Magic has long been a pinnacle of illustration work, and now that the market for original paintings has risen to that same level of importance amongst collectors, it’s time for those same monetary benefits to extend to those working alongside their traditional compatriots.

Cryptoart collectors and collections will most likely become a reality, and are very possibly here to stay. And no, it won’t be for every artist or every collector. It’s seeming inevitability means it’s important to start trying to figure out how to make it as safe and user and environmentally friendly as possible. Real options are being pioneered every day that will help to these ends.

Wrapping Up

NFT history is being written and rewritten almost daily, and it remains to be seen whether it will be a post-pandemic fad or something that changes the very landscape of the art market and what it means to own an “original” piece of artwork. How it ultimately translates to Magic could change the game and its artists forever, and it cannot be ignored.

I owe a great thanks to Jisu for writing their original article and illuminating so much of what is going on in this arena. Furthermore, thanks to Karla Ortiz for sharing this in-depth work, and providing that constant inspiration of exploration to take the deep dive and try to figure out what this means for Magic moving forward. And finally to Titus Lunter, who provided innumerable insights and was my devil’s advocate as I tried to work through these evolving issues.

At this point I am conclusively cautiously optimistic that NFTs will evolve in a responsible way while at the same time putting money in artist’s pockets. As an art collector, NFTs probably won’t be for me, and I don’t know that I’ll ever acquire one. I am very much a touch it, feel it, silver over stocks kind of person. But as an art critic, I think this could be a serious game changer for a lot of people, and that means it’s deserving of attention, at least for now.

This will be a developing story. Remember, to see original #mtgart and other #vorthos related things, follow me on Twitter. Feel free to ask questions or retweet to continue the conversation. Thanks and see you next time!

Donny Caltrider has been playing Magic since 2002 and collecting original Magic art since 2017. He has an M.A. in Museum Studies from Johns Hopkins University and enjoys telling stories about art, objects, and the intersection of fantasy with real-life. You can find him on Twitter talking about #mtgart, museums, and other #vorthos related goodness. Follow along and continue the conversation!